Christchurch Real Estate: January Update

Harcourts’ South Island Regional Manager, Jim Davis, comments on the Christchurch real estate market.

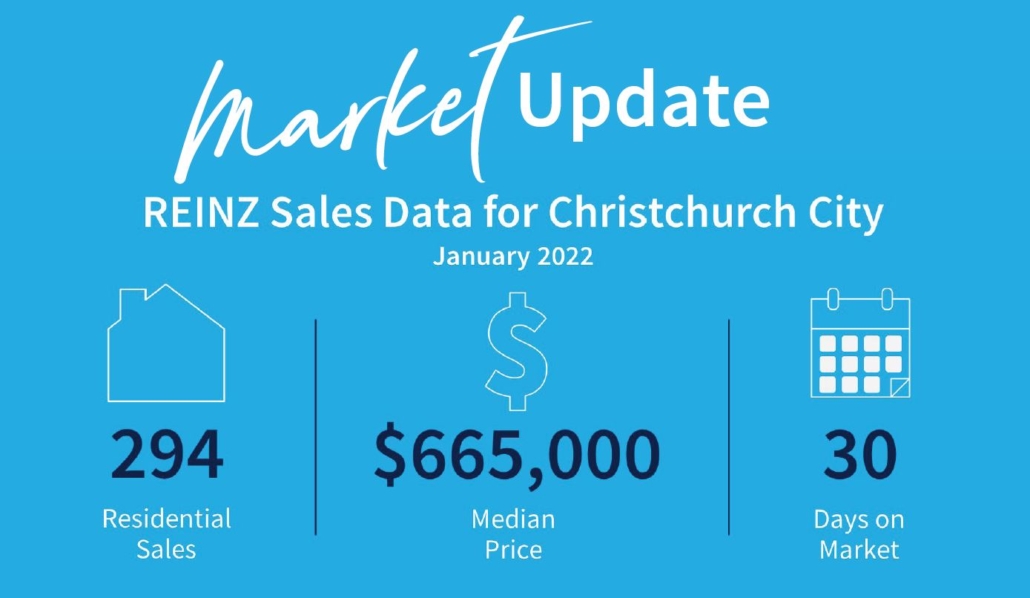

The data has just been released from the Real Estate Institute of New Zealand relating to sales during the month of January. On the surface, the data shows a significant drop in the number of sales in the month both nationally and locally but little significant movement in the median values across the country. As with any data, interpretation of the figures can usually be made to support or contradict whatever premise a commentator might have. Over the coming weeks, I suspect much will get made of the drop off in actual sales volumes, and stories will abound that first home buyers have left the market in droves and the inevitable price drops will follow.

The reality I suspect will be quite different. January is always a statistically different month, simply because of the holiday period. This January was no different. Nationally very few offices and even fewer consultants were back into the business of real estate before the 17th of January this year, with a good number being even later. This was partially due to the timing of the Christmas /New Year period and partially because there was just simply a need for people, including the owners of houses, to have an extended break because of the manic market everyone experienced the previous year. Everyone just needed a longer break.

The result is that for the majority of the market there was less than two weeks of business activity conducted in January. Most real estate people were still on holiday so not as much property was either listed or sold during the month.

Over-analysing these figures as a guide to what might or might not happen for the rest of the year is likely to be a little misleading. Having said that, the figures are the figures and what they show for Christchurch in January are that there was a significant slowdown of activity, which meant the recorded sales volume dropped away to a total of 294 properties sold. This volume is down around 33% on January 2021. With the drop in number of properties sold, the median sale price achieved dipped slightly from the record high achieved in December 2021, to $665,000. Additionally, the days on market slipped out to 30 as a result of so many in the industry being on holiday.

The big question on everyone’s lips going forward is what is likely to happen for the rest of this year? The simple answer is nobody knows and, as with many economic and Covid related predictions, the results often vary hugely from the predictions.

What I can do however is relate what I think will happen within Christchurch and surrounding areas based on what we see within the Harcourts market. The volume of new stock coming to the market is still very tight, consequently the volume of newly listed property coming into the marketplace is low. Of the new stock that is coming to the market, almost 60% is being listed for sale by auction. Harcourts is well known across the city for using the auction method of sale and for good reason – we achieve significant benefits for our vendors utilising this method. We recently looked at the data for Harcourts Christchurch sales achieved over the last six months of last year. It is interesting to see that the median sale price across all our auction sales was $800,000, whereas the median sale price of property sold by all other methods of sale was $654,000. That’s why we believe auction is the best option for a seller. Much is being said about the new regulations and that the first home buyer market has all but disappeared.

This is simply not true, or not yet anyway. Statistics just released show that late last year first home buyers made up 26% of the market. Despite increasing interest rates and rampant prices they are still supposedly 24% of the current market. That small percentage drop off is insignificant when you understand that there are still huge numbers of other buyers in the background waiting for the chance to purchase. Also, remember that the vast majority of the buyer pool, over 75%, are not first home buyers and not necessarily subject to the tougher lending regulations due to their equity levels. There is no doubt that the majority of people would like to see the previous rampant property price growth reigned in, however I don’t see that happening in the immediate future for us here in Canterbury/ Christchurch. Demand is still too strong at this stage. Over 34 years experience in real estate tells me that when listing stock levels remain low like they are currently, then prices will remain strong, and this is doubly so when it coincides with huge demand from buyers. I have said it before, just wait until MIQ disappears completely and everyone who wishes to can come home to New Zealand. Where are we all going to live?

When the February/ March figures start to unfold, we will see a truer picture of what might be in store for us all in the local real estate market. At this stage it’s too soon to be 100% certain. The one thing you can be sure of however is that Harcourts sells the vast majority of property in Christchurch and our auction system, training and numbers ensure we achieve the best possible price on the day.

You ever only sell once so you might as well get the best possible outcome, and that is exactly what Harcourts achieves for our clients.